Why Smart Investors Are Buying Zepto Unlisted Shares Through CCPS Before the IPO

In today’s startup and private investment ecosystem, raising capital is no longer just about issuing shares and collecting money. It is about balancing money, control, risk, trust, and future expectations. Especially in the unlisted market, where companies are still evolving and uncertainty is high, traditional equity structures often fail to serve both founders and investors effectively.

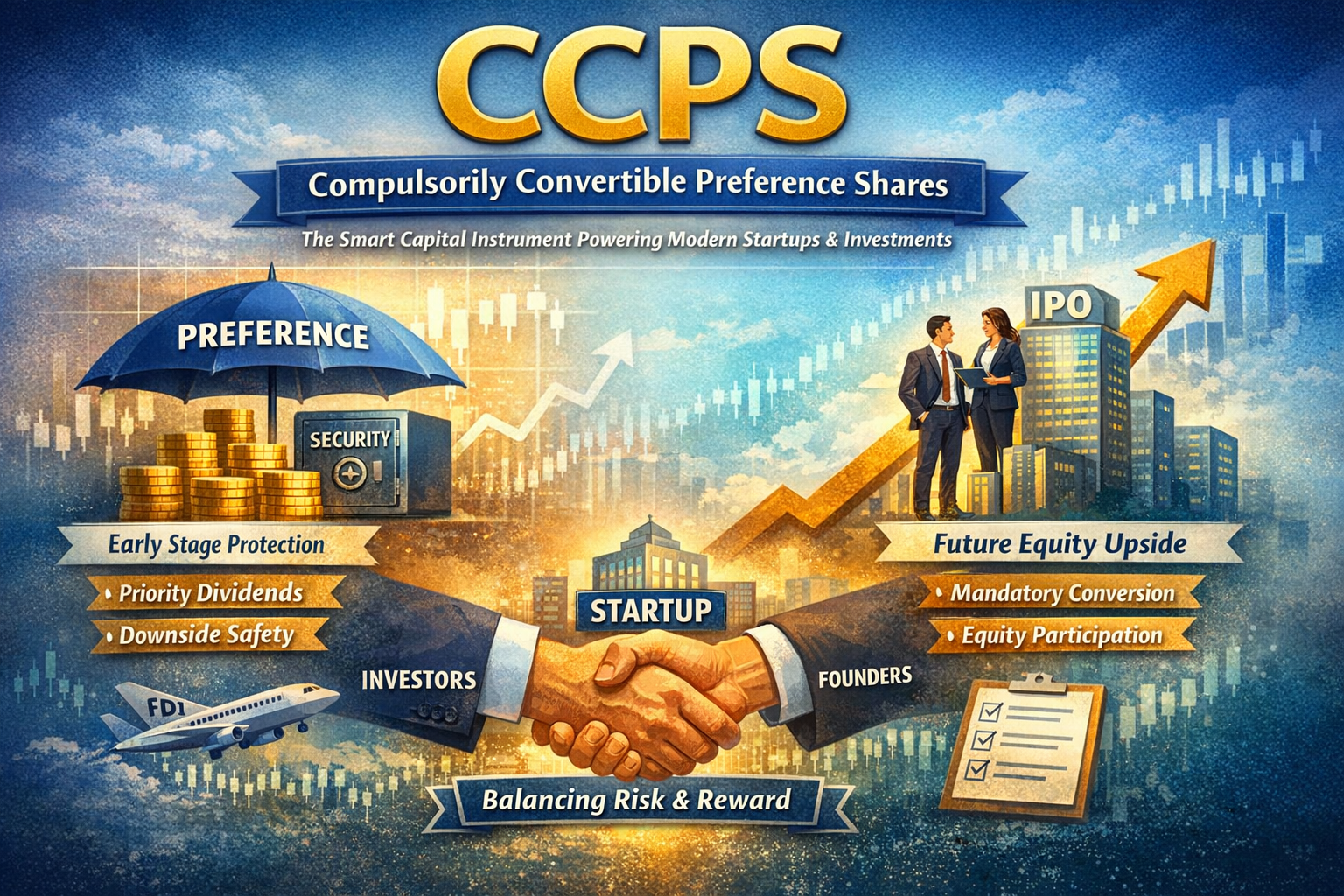

This is where Compulsorily Convertible Preference Shares (CCPS) come into the picture.

Over the last decade, CCPS have become one of the most widely used capital instruments in India—particularly in startups, private equity deals, and foreign investments. They are not popular because they are fancy, but because they solve real problems that plain equity or debt cannot.

What Exactly Are CCPS?

Compulsorily Convertible Preference Shares are a type of preference share that must be converted into equity shares after a certain period or on the occurrence of a specific event, such as the next funding round, IPO, or a predefined date.

The key word here is “compulsorily.”

There is no option to ask for cash repayment instead. Conversion into equity is mandatory.

In practical terms, CCPS behave like:

- A protected investment in the early stage, and

- A full equity investment in the long term

That is why people often describe CCPS as:

- Debt-like in the beginning (because of protection and preference), and

- Equity-like in the future (because of ownership and upside)

This hybrid nature makes CCPS extremely useful in situations where the company’s future looks promising, but today’s numbers do not tell the full story.

Why CCPS Are Mostly Seen in the Unlisted Market

In listed companies, share prices are decided by the market every day. But in unlisted companies, there is no daily price discovery. Valuation is subjective and often controversial.

A young or growing company may have:

- A strong idea but unstable revenues

- Fast growth but no profits

- High potential but unclear timelines

If such a company issues equity directly, one of two things happens:

- Founders feel the valuation is too low and fear losing control

- Investors feel the valuation is too high and fear losing money

CCPS are designed to reduce this friction.

They allow investment today, while postponing the final equity outcome to a time when the business is more mature and valuation is easier to justify.

How CCPS Actually Work in Practice

When a company issues CCPS, the investor does not immediately become a normal equity shareholder. Instead, the investor holds preference shares with certain special rights.

These rights usually include:

- Preference in dividends (if declared)

- Priority in repayment during liquidation

- Assured conversion into equity later

The conversion ratio or price is decided upfront or linked to a future event, such as the next funding round. For example, one CCPS may convert into multiple equity shares depending on valuation achieved later.

This structure ensures that the investor is protected in the downside while still participating fully in the upside once the company succeeds.

Why Companies Offer CCPS Instead of Equity

From the company’s perspective, CCPS are not about avoiding investors. They are about protecting operational freedom in the early years.

In unlisted companies, especially startups, founders are deeply involved in daily decisions. Giving away voting equity too early can:

- Slow decision-making

- Create conflicting visions

- Force founders into defensive management

By issuing CCPS, companies can raise capital without immediately disturbing voting control. Founders continue to run the business, while investors remain economically protected.

Equity dilution happens later—when the company is stronger, more stable, and better valued.

Why Some CCPS Do Not Carry Voting Rights

This is one of the most misunderstood aspects.

Many people assume that if someone invests money, they must get voting rights. In reality, economic rights and voting rights are two different things.

In CCPS, voting rights are often:

- Limited, or

- Applicable only to specific situations

This is legally permitted under the Companies Act, 2013.

The logic is simple:

Companies want capital support, not day-to-day interference.

Most strategic control in unlisted companies does not come from voting in general meetings. It comes from:

- Shareholder agreements

- Board seats

- Veto rights on key decisions

So even without regular voting rights, investors remain well protected through contractual arrangements.

Voting rights are usually activated only when:

- Conversion terms are altered

- Dividend or preference rights are affected

- The company is being wound up

This ensures fairness without disturbing operational stability.

Why Investors Still Agree to Such Structures

Experienced investors understand that early-stage control is overrated and early-stage protection is underrated.

Investors prefer CCPS because they provide:

- Downside safety through preference rights

- Guaranteed equity participation in the future

- Clear exit alignment through conversion

Instead of focusing on controlling the company today, investors focus on owning value tomorrow.

Once CCPS convert into equity—often at IPO or a major funding round—the investor becomes a normal shareholder with full rights.

Regulatory Comfort Around CCPS in India

Another major reason for the popularity of CCPS is regulatory clarity.

In India:

- The Companies Act, 2013 allows preference shares with differential rights

- RBI and FEMA treat CCPS as equity instruments, provided conversion is mandatory

- This makes CCPS fully compliant for FDI

Because of this, CCPS have become the default instrument for foreign and institutional investment in Indian unlisted companies.

CCPS vs Plain Equity (In Real Terms)

Plain equity is simple, but it is rigid.

CCPS are structured, but they are flexible.

Equity forces everyone to agree on valuation today.

CCPS allow everyone to agree on belief today and valuation tomorrow.

That is the real difference.

Why Almost Every Unicorn Has Used CCPS

Most Indian startups that later became unicorns raised their early and mid-stage funding through CCPS. Not because they had no choice—but because it was the most sensible option at that stage. CCPS allowed them to:

- Raise serious capital

- Retain founder control

- Protect investors

- Stay legally compliant

- Prepare for future equity rounds

Final Thought

CCPS are not loopholes.

They are not tricks.

They are financial instruments designed for uncertainty.

They exist because unlisted businesses grow in imperfect conditions, and both founders and investors need a structure that respects that reality.

In a world where capital is available but trust must be built, CCPS act as a bridge between ambition and assurance.

If startups are the engines of economic growth, CCPS are the stabilizers that keep those engines running until they are strong enough to fly on pure equity.

INDIA

INDIA

About the Author